how are 457 withdrawals taxed

How much of my social security benefit may be taxed. How much disability income.

Retirement Income Calculator Faq

A Roth IRA is an individual retirement account IRA that allows qualified withdrawals on a tax-free basis if certain conditions are satisfied.

. What are the tax implications of paying interest. 457 plans are taxed as income similar to a 401k or 403b when distributions are taken. 2019 tax refund estimator.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent regardless of the age of the beneficiaryHowever distributions are still taxed as ordinary incomeBeneficiaries can avoid taxation by rolling over the 457 distribution to a qualified. The only difference is there are no withdraw penalties and. What are my needs for burial and final expenses.

How much life insurance do I need. Should I itemize or take the standard deduction. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately.

What is my tax-equivalent yield. It was established in 1997 and named after William. What is my life expectancy.

How A 457 Plan Works After Retirement

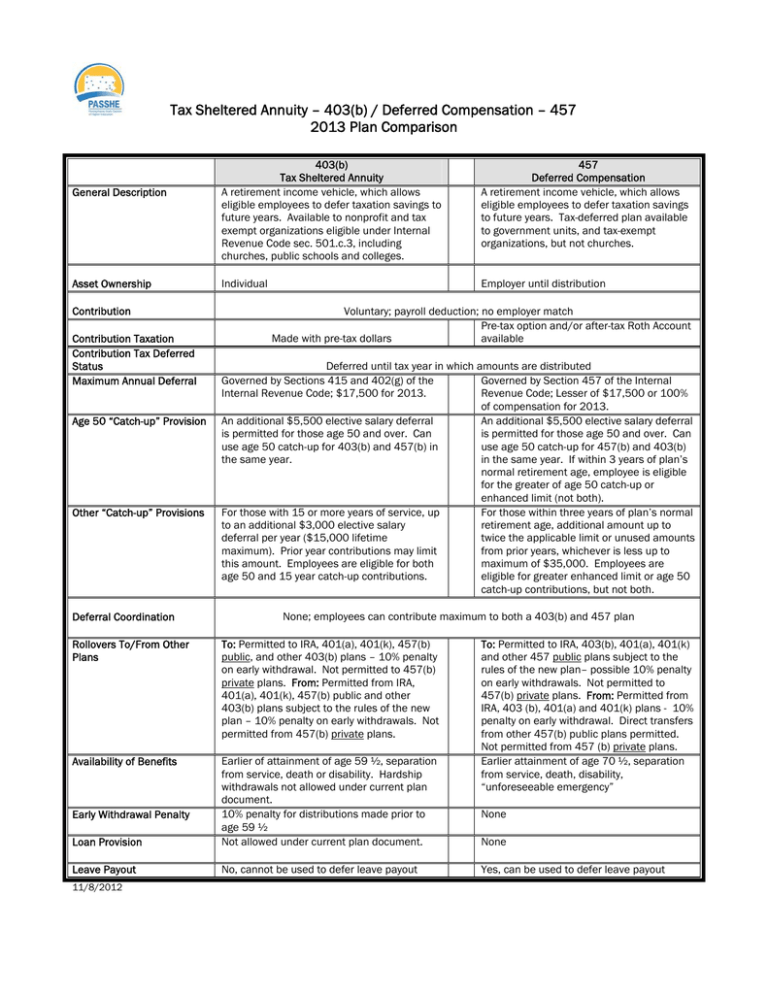

Tax Sheltered Annuity 403 B Deferred Compensation 457

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

How To Access Retirement Funds Early

A Guide To 457 B Retirement Plans Smartasset

Everything You Need To Know About A 457 Real World Made Easy