income tax rates 2022/23 scotland

All Tax Calculators on iCalculator are updated with the latest Tax Rates and Personal Allowances for 202223 tax year. Historical Revenue and Expenditure.

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot

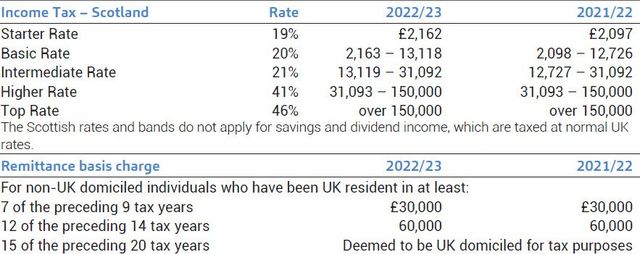

Scottish income tax bands 202223 Scottish starter rate 19.

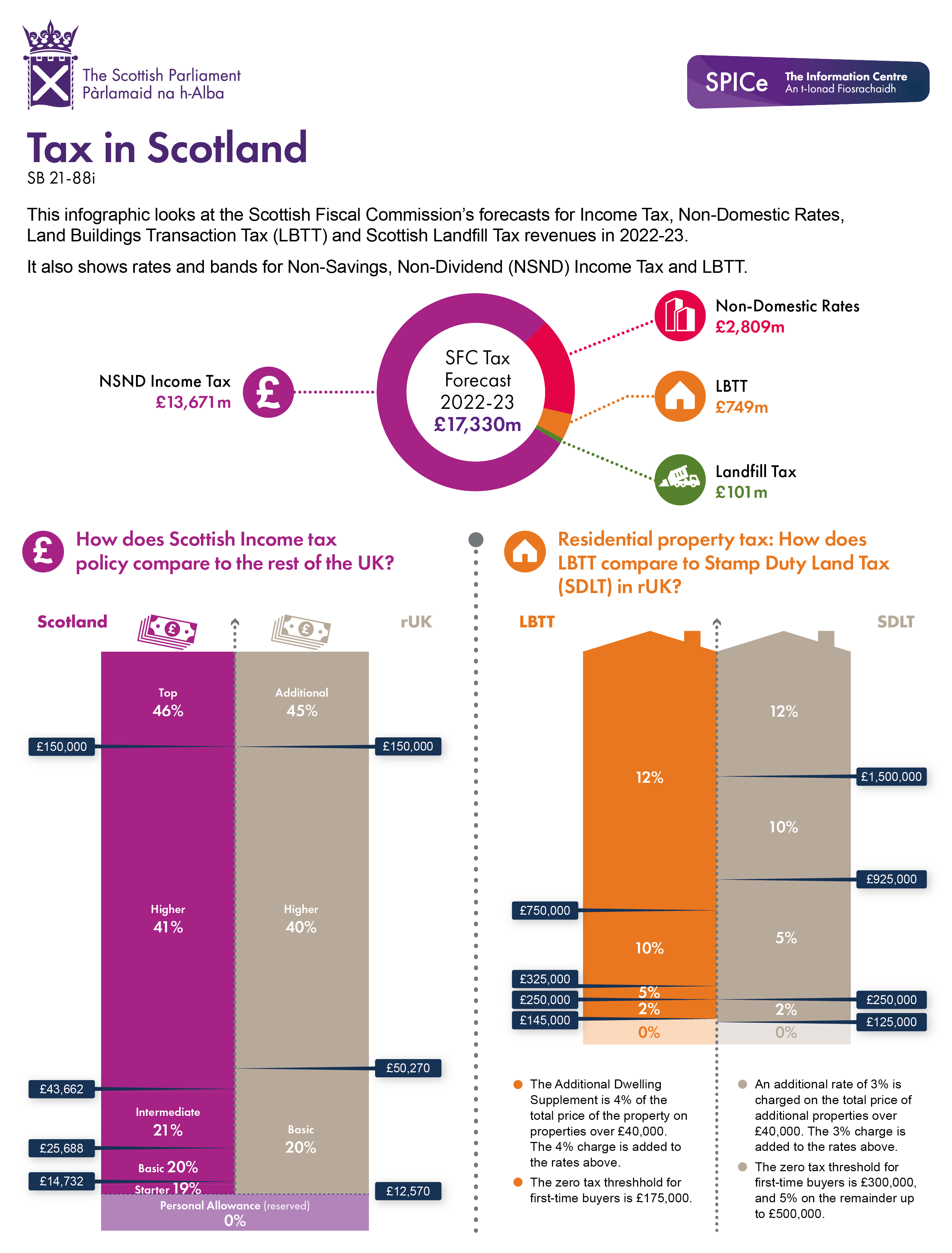

. The Scottish Fiscal Commission have forecast that Income Tax will raise 13671 million in 2022-23 in Scotland. You do not get a Personal Allowance if you earn over. Working holiday maker tax rates 202223.

The rate of Income Tax you pay depends on how much of your taxable income is above your Personal Allowance in the tax year. Income tax bands are different if you live in Scotland. Those earning less than 27850 will pay slightly less income tax in 2022-23 than if they lived.

Guide setting out key information about how the system of public finances in Scotland stands in 2022 to 2023 and how this system is changing. You pay a different rate of tax for income from the tax year 6 April 2021 to 5 April 2022. If you are resident in Scotland your income tax will be as follows.

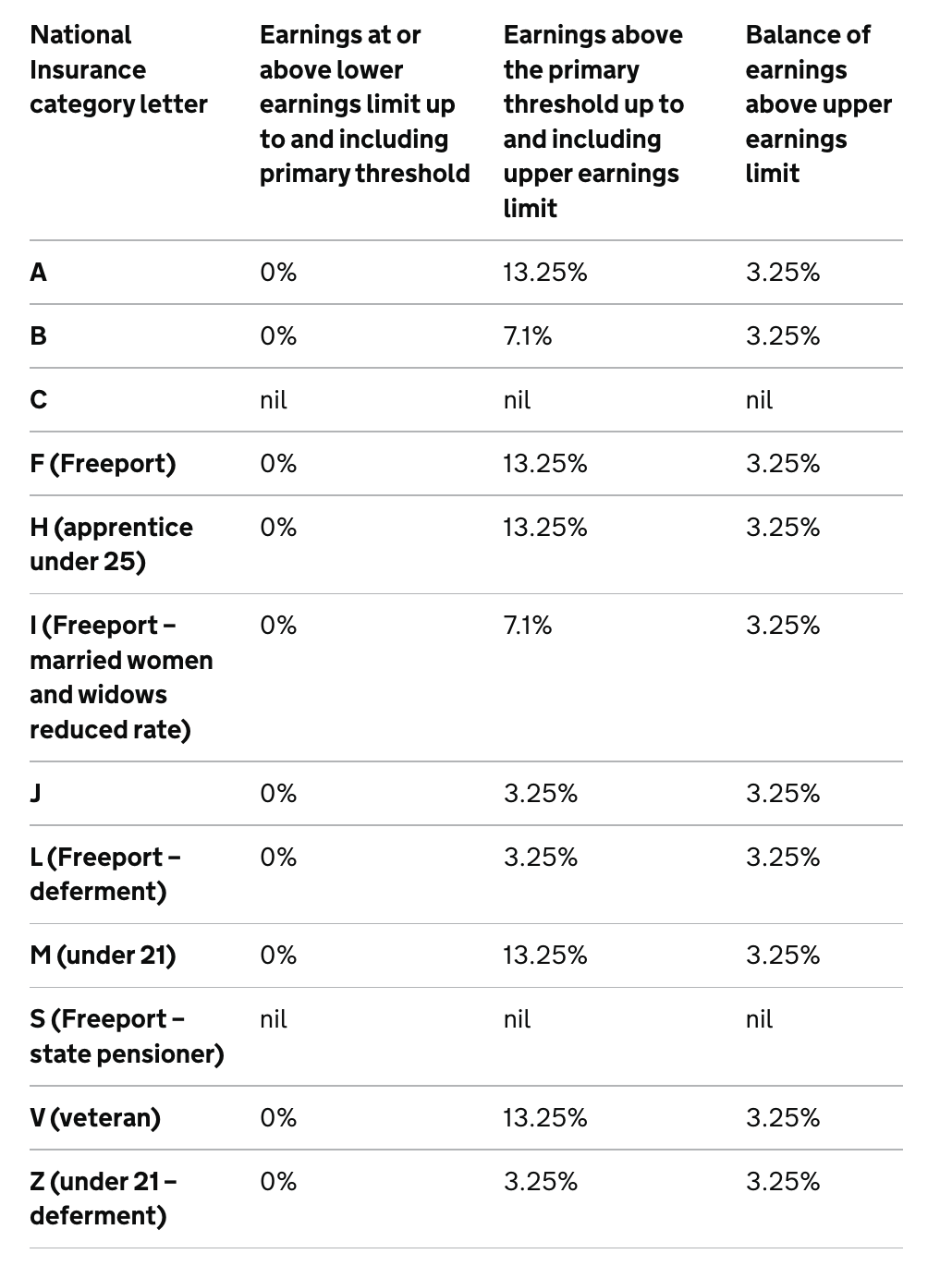

As a result male taxpayers are expected to contribute around 69 to total Income Tax liabilities in Scotland in 2022-23. If your home is in. Employee earnings threshold for student loan plan 1.

31125 plus 37 cents for each 1 over. The current tax year is from 6 April 2022 to 5 April 2023. It will automatically calculate and deduct repayments from their pay.

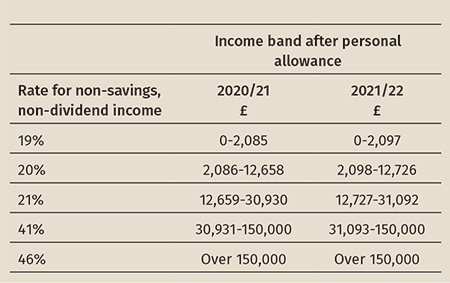

About 48 of Income Tax is paid by male Higher and Top. On 25 February 2021 the Scottish Parliament set the following Income Tax rates and bands for 2021 to 2022 which will take effect from 6 April 2021. Scottish income tax rates 202223.

Band Taxable income Tax rate. HMRC have published separate Scottish payroll tax tables for tax years 201617 onwards to deal with the different Scottish higher rate threshold and now the five rates and. Proposed Income Tax Rates and Bands 2021-22 2022-23.

12571 14732 2162 Scottish basic rate 20. Your Personal Allowance is the amount of. Historical Revenue and Expenditure Per Head.

Scottish Tax Rates 2022-23. D a higher rate of 41 charged on income above 31092 and up to a limit of 150000 and e a top rate of 46 charged on income above 150000. ICalculator Scottish Tax Calculator is updated for the 202223 tax year.

If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator. The table shows the 2022 to 2023 Scottish Income Tax rates you pay in each band if you have a standard Personal Allowance of 12570. 2022 to 2023 rate.

Scottish basic rate - 10956 at 20 219120. Scottish starter rate - 2162 at 19 41078. Tax on this income.

Scotland Share of UK Deficit.

Scottish Budget 2022 To 2023 Your Scotland Your Finances Gov Scot

Scottish Budget 2022 23 Summary Greaves West Ayre

Scottish Budget 2022 23 Taxes Infographic Scottish Parliament

2021 22 Uk Tax Year End Planning For Americans In The Uk

Budget 2022 23 Mind The Block Grant Adjustment Gap Spice Spotlight Solas Air Spice

Guide To Tax Rates And Allowances 2022 23 Burton Sweet

Challenging Income Tax Decisions Ahead For The Scottish Government Spice Spotlight Solas Air Spice

2022 23 Uk Income Tax And National Insurance Rates

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Tax Rates And Thresholds For 2022 23 Brightpay Documentation

Income Tax Proposals In The Conservative Leadership Campaign Implications For The Scottish Budget Fai

Tax Rates And Allowances 2022 23 Cooper Weston Payroll Services

Half A Million Scots Face Paying Whopping 54 25 On Wages After Tories Hated National Insurance Hike The Scottish Sun

Uk Tax Cuts How Much Better Off Will I Be Daily Mail Online

How The Income Tax Freeze Will Affect Your Wages The Sun

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot